“Unlock Your Financial Future: Expert Business Management and Financial Services for a Secure Retirement!”

What are your thoughts on this?

Why NPS is the Ideal Retirement Savings Plan in India

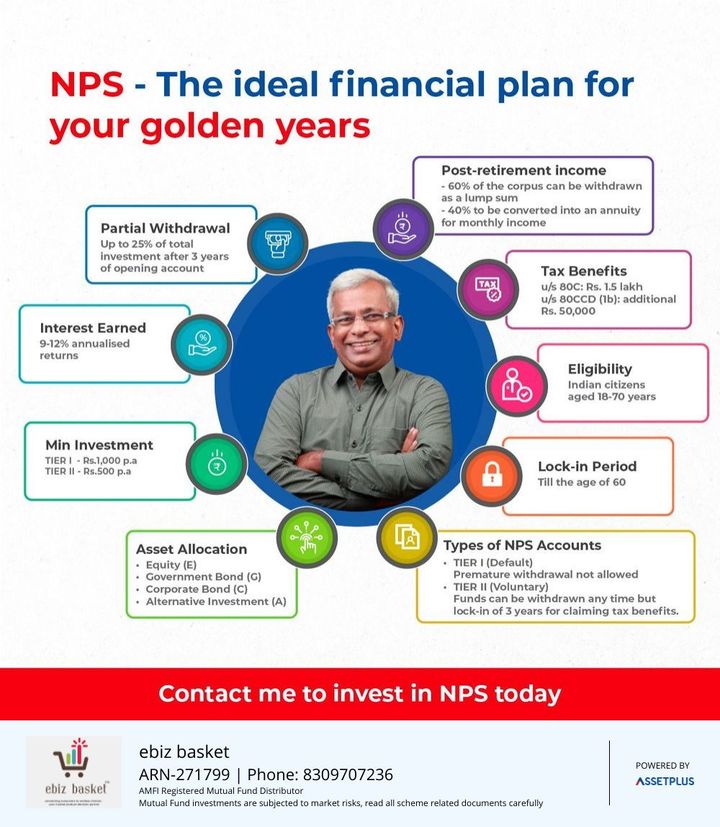

Planning for retirement is crucial to ensure financial security and stability in your post-retirement years. The National Pension System (NPS) in India is a government-backed retirement savings plan designed to help individuals build a substantial corpus for their retirement.

Flexibility and Portability

One of the key advantages of NPS is its flexibility. Investors have the option to choose their pension fund managers and investment options based on their risk appetite and financial goals. Additionally, NPS is a portable scheme, allowing individuals to contribute from anywhere in India, making it convenient for those who may relocate for work or personal reasons.

Tax Efficiency

NPS offers tax benefits to investors, making it an attractive retirement planning tool. Contributions made towards NPS are eligible for tax deductions under Section 80C of the Income Tax Act, up to a specified limit. Furthermore, the returns generated and the lump sum amount received on maturity are also tax-efficient, providing additional savings for investors.

Professional Guidance

As a Business Management Consultant and experienced financial advisor in India, ebizbasket can provide expert guidance on how to maximize the benefits of NPS for your retirement planning. With a deep understanding of the financial landscape and retirement planning strategies, ebizbasket can help you make informed decisions to secure your financial future.

Book a Consultation Call

If you are ready to take the first step towards securing your retirement with NPS, book a consultation call with ebizbasket today. Contact us at info@ebizbasket.tech to schedule your appointment and start planning for a financially stable retirement.